- 10.11.2020

- Ecological justice

- Array

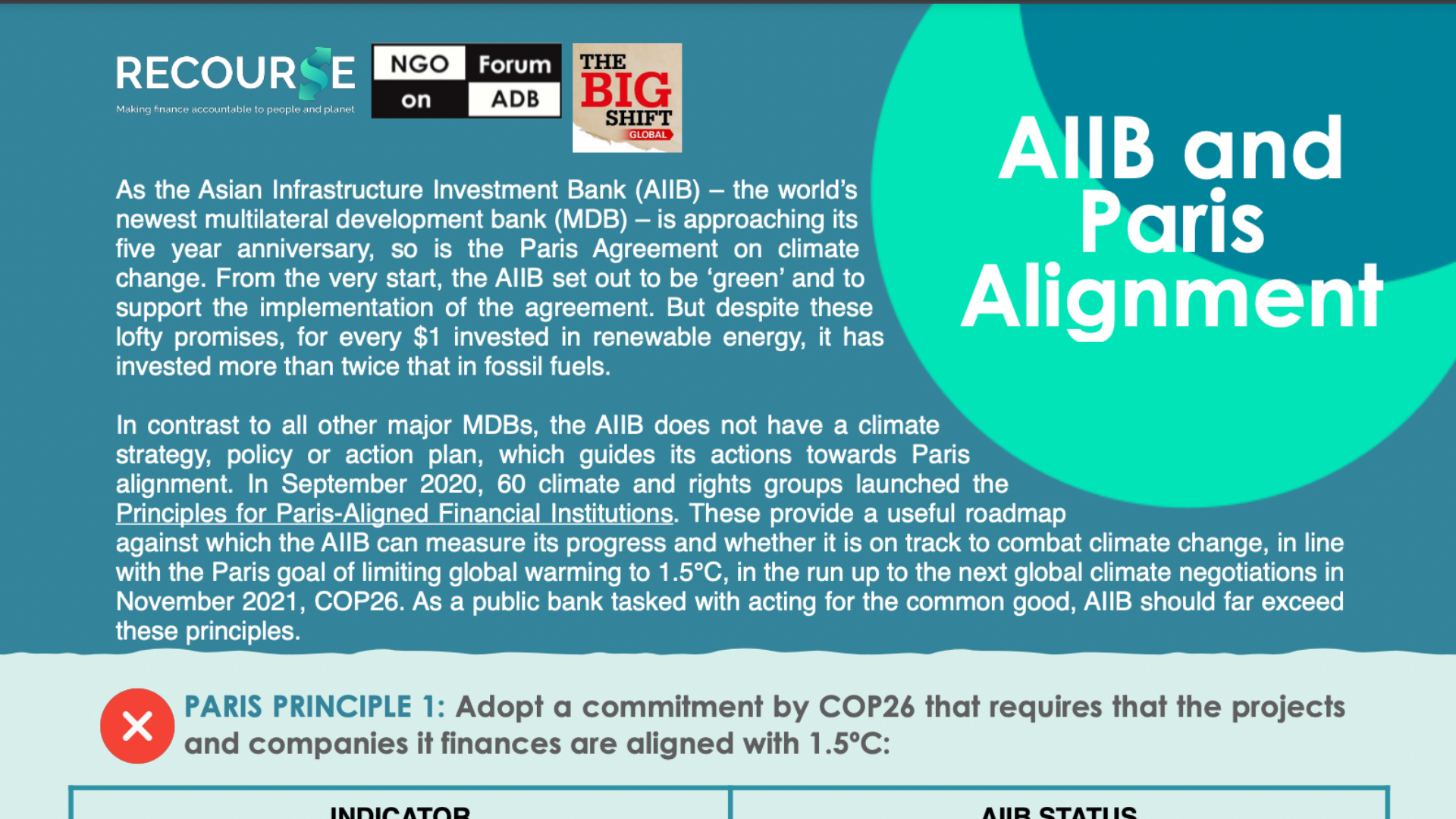

As the Asian Infrastructure Investment Bank (AIIB) – the world’s newest multilateral development bank (MDB) – is approaching its five year anniversary, so is the Paris Agreement on climate change. From the very start, the AIIB set out to be ‘green’ and to support the implementation of the agreement. But despite these lofty promises, for every $1 invested in renewable energy, it has invested more than twice that in fossil fuels. In contrast to all other major MDBs, the AIIB does not have a climate strategy, policy or action plan, which guides its actions towards Paris alignment.

In September 2020, 60 climate and rights groups launched the Principles for Paris-Aligned Financial Institutions. These provide a useful roadmap against which the AIIB can measure its progress and whether it is on track to combat climate change, in line with the Paris goal of limiting global warming to 1.5°C. As a public development bank, AIIB should far exceed these principles. But Recourse’s assessment shows that the AIIB still has a long way to go.

The French government is hosting the ‘Finance in Common’ summit 9 – 12 November 2020, which brings together public development banks to ‘implement the transition to a low carbon and resilient economy’ as part of the build-up to the next round of climate negotiations (COP26). With COP26 postponed until 2021 due to the Covid-19 pandemic, this summit presents an important opportunity for the AIIB to stake out a roadmap for meaningful climate action towards COP26, together with its MDB peers.

Read more in Recourse’s new infographic AIIB and Paris Alignment, in collaboration with NGO Forum on ADB and the Big Shift Global Coalition.